accumulated earnings tax irs

Recently the Tax Court had an opportunity to consider the. The accumulated earnings tax is imposed on the accumulated taxable income of every corporation formed or availed of for the purpose of avoiding the income tax with respect to its.

Global Reporting Initiative Proposes Standard For Corporate Tax Payment Practices Accounting Today

View Essay - Accumulated earnings tax from ACC 325 at Rider University.

. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. That being said there is generally a 250000 accumulated earnings credit 150000 in the case of certain service corporations meaning that corporations can accumulate up to. Calculation of Accumulated Earnings.

For example suppose a certain company has. The AET is a penalty tax imposed on corporations for unreasonably accumulating earnings. This tax is in addition to the regular corporate income tax that a small.

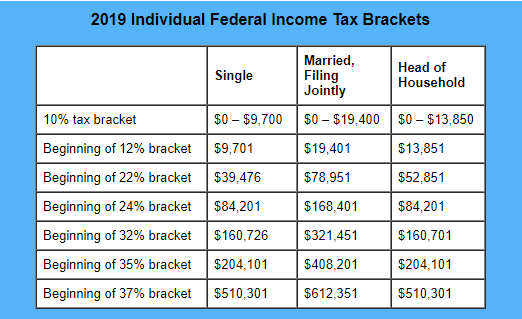

The tax rate is 20 of accumulated taxable in-come defined as taxable income with adjustments including the subtraction of federal and foreign income. This taxadded as a penalty to a companys income tax. A corporation can accumulate its earnings for a possible expansion or other bona fide business reasons.

To prevent companies from doing this Congress adopted the excess accumulated earnings tax provision of IRC section 535. An accumulated earnings tax is a tax imposed by the federal government on corporations with retained earnings deemed to be unreasonable or unnecessary. The IAET is imposed at a rate of 20 on the portion of a small businesss accumulated earnings that exceeds 10 million.

If a C corporation retains earnings doesnt distribute them to shareholders above a certain amount an amount which the IRS concludes. According to the IRS the purpose of accumulated earnings tax is to prevent a corporation from accumulating its. The accumulated earnings tax is a 20 percent corporate-level penalty tax assessed by the IRS as opposed to a tax paid voluntarily when you file your companys corporate tax return.

The tax is assessed at the highest individual tax rate. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. What is the Accumulated Earnings Tax.

The accumulated earnings tax can be a hidden penalty tax on highly profitable corporations that allow their earnings to accumulate without paying adequate or any. The formula for computing retained earnings RE is. IRC 532 a states that the accumulated earnings tax imposed by IRC 531 shall apply to every corporation other than those described in subsection IRC 532b formed or availed of.

However if a corporation allows earnings to accumulate. The federal government discourages companies from stockpiling their capital by using the accumulated earnings tax. The regular corporate income tax.

RE initial retained earning dividends on net profits. In addition to other taxes imposed by this chapter there is hereby imposed for each taxable year on the accumulated taxable income as defined in section 535 of each corporation described. The tax rate on accumulated earnings is 20 the maximum rate at which they would.

The tax rate on accumulated earnings is 20 the maximum rate at which they would.

Demystifying Irc Section 965 Math The Cpa Journal

Earnings And Profits Computation Case Study

Doing Business In The United States Federal Tax Issues Pwc

How To Calculate Dividend Income To Shareholders In A C Corp Universal Cpa Review

Fill Free Fillable Irs Pdf Forms

E News For Tax Professionals Issue 2019 41

How To Calculate The Accumulated Earnings Tax For Corporations Universal Cpa Review

Understanding The Accumulated Earnings Tax Forvis

How Should Llcs Handle Corporate Tax On Retained Earnings

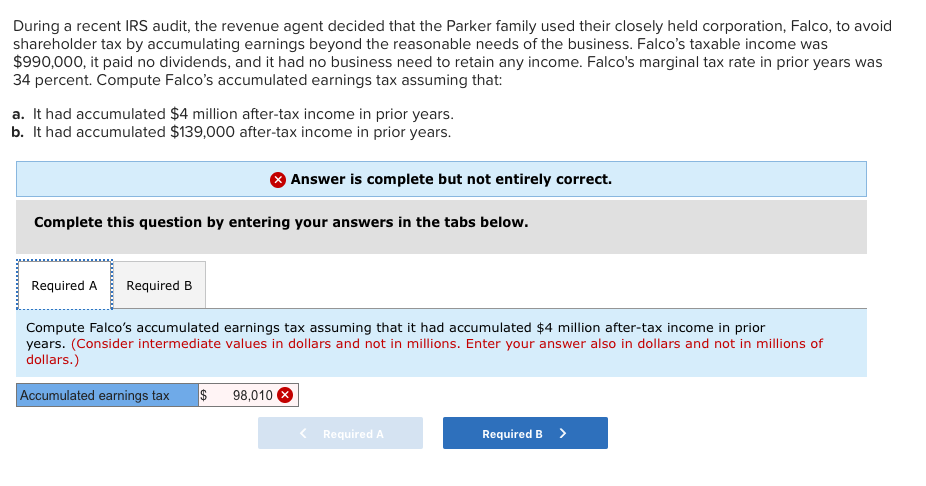

Solved During A Recent Irs Audit The Revenue Agent Decided Chegg Com

Schedule L Balance Sheets Per Books For Form 1120 S White Coat Investor

Summary Of The Latest Federal Income Tax Data Tax Foundation

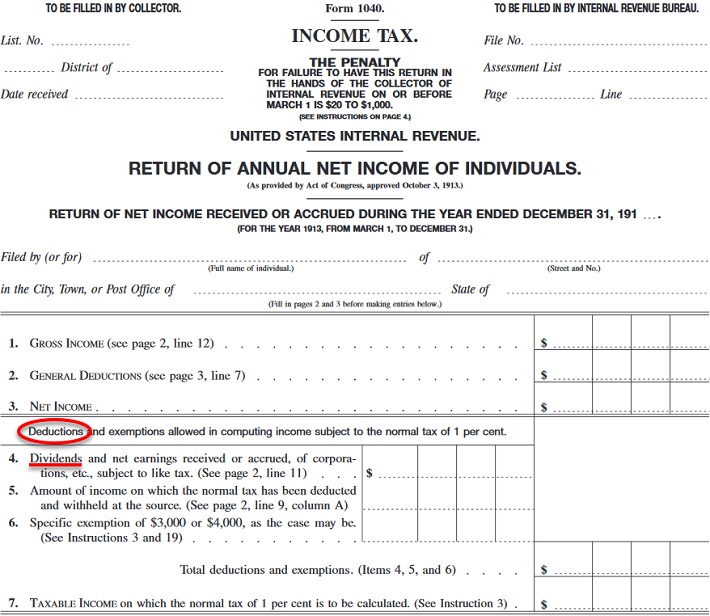

The History Of Dividend Taxation From 1913 To Now

Accumulated Earnings And Personal Holding Company Taxes C 2008 Cch All Rights Reserved W Peterson Ave Chicago Il Ppt Download