gift in kind donation

Out of an abundance of caution we are limiting the in-kind donation items we can accept for our patients. Gift-In-Kind Distribution Center Kent 8226 South 208 th Street Suite G110 Kent WA 98032 Monday-Friday 830am4pm Closed early 92 at 11am and for.

Valuing And Reporting Gifts In Kind And Donated Services Marks Paneth

In-kind donations for nonprofits can be made by individuals corporations and businesses.

. Naturally your In-Kind donation cannot be considered the same as cash relative to IRS regulations but any smart non-profit would recognize your In-Kind donation in the same way. Your donation will help support the cost of sending life changing aid to our beneficiaries. Donations to the Florida Disaster Fund are made to the Volunteer Florida Foundation a 501c3 charitable organization and are tax-deductible.

An in-kind gift is recorded in the books and records at fair market value as contribution revenue and also as an asset or expenses in the period received. Individuals corporations and businesses can all make in. In-kind giving platforms like DonationMatch are built to easily facilitate record and manage the in-kind giving process for companies that distribute thousands of donations a.

Some examples of in. Since the standards for recognizing contributions at their fair value were issued in 1993 NFPs have been challenged to measure the value of the myriad contributions they. Corporations and businesses are the most common source of in-kind.

The lifeblood for some. In-kind donations for nonprofits refers to types of contributions that dont involve cash. After a Gift In Kind non-cash donation is made each campus department is responsible for issuing a donor acknowledgment letter to all donors and keeping a copy on file.

While determining the fair value of cash. We appreciate your consideration in supporting us in one of the following ways. Gift-in-kind or GIK is a type of charitable giving in which contributions take the form of tangible goods rather than money whether that be supplies equipment and materials or services and.

In-kind donations are valued in monetary terms and they should be recorded on a companys budget for a value equal to the value of in-kind gifts the non-profit organization receives. An in-kind donation is a non-cash gift made to a nonprofit organization including goods services time and expertise. They are typically non-monetary gifts given to.

Contributions of nonfinancial assets or so-called gifts-in-kind GIK can be an important source of financial support for nonprofits. Most people dont know what does in-kind donation mean. In-kind donation also known as gift in kind are contributions of goods services or time instead of cash.

In-kind donations are accepted at Seattle Humane during. It includes goods services time or professional services. By donating toward shipping expenses your donation allows Rise Against Hunger to stretch our.

In-kind donations are non-cash gifts made to nonprofit organizations. However in-kind donation meaning is quite straightforward.

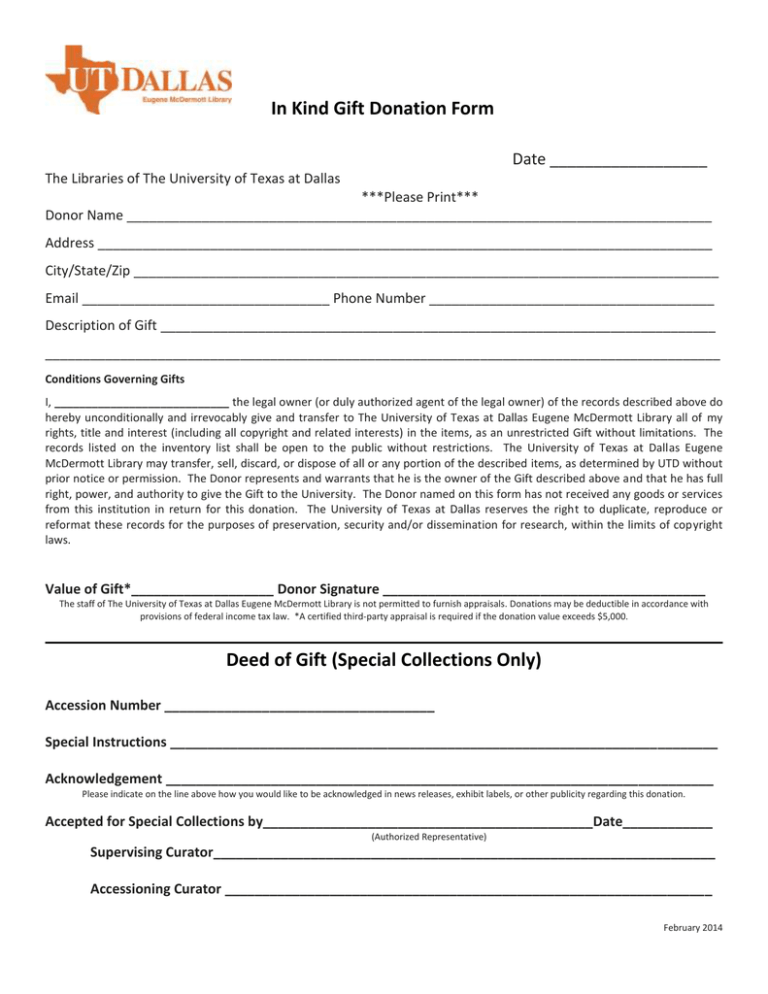

In Kind Gift Donation Form Date

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Free In Kind Personal Property Donation Receipt Template Pdf Word Eforms

In Kind Donation Form Orlando Science Center

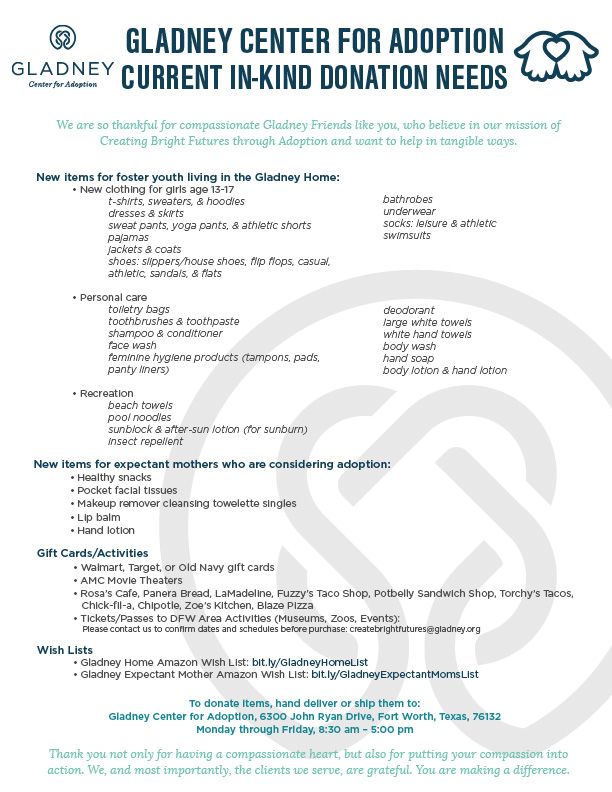

In Kind Donations I Am Gladney

Accounting And Reporting For Stock Gift Donations To Nonprofits

All Your Nonprofit Needs To Know About In Kind Donations

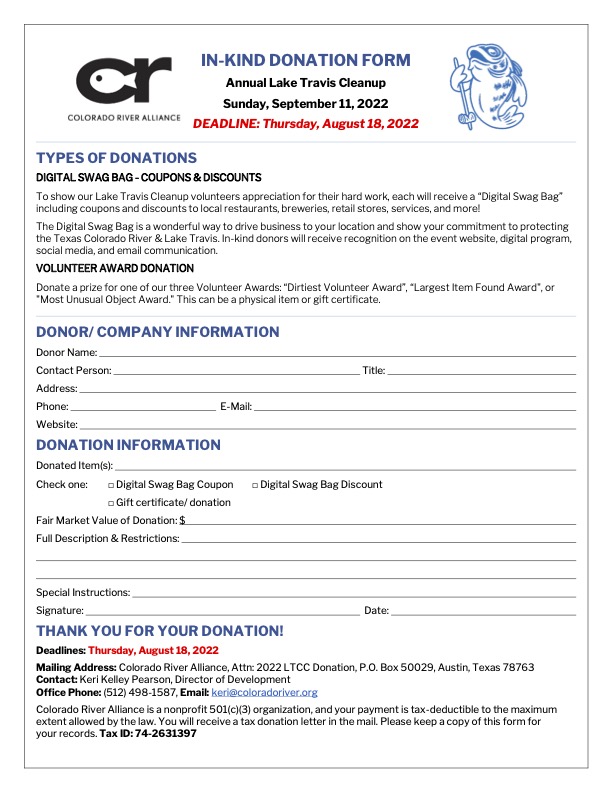

In Kind Donations Lake Travis Cleanup

Donation Letters How To Write Them 3 Templates

Explore Our Printable Gift In Kind Donation Receipt Template Receipt Template Donation Letter Donation Letter Template

Add A Gift In Kind Donation To Inventory Salsa Knowledgebase

How To Donate Your Valuables And Noncash Items

Gift In Kind Receiving Humanitarian Software

Charitable Gifts And Donations Tracker

Fillable Online Bishopodowd Gift In Kind Donation Form Bishop Odowd High School Bishopodowd Fax Email Print Pdffiller

Touchpoint Software Documentation Non Tax Deductible Gifts And Pledges